As noted in a recent Goldman Sachs report, some 65 percent of furniture imported into the U.S. is from China, and a 25 percent tariff imposed on another $200 billion of Chinese goods, including furniture, appears imminent. While at press time, trade talks between the U.S. and China are continuing, the mood in Washington is one of defiance, and the mood across the furniture industry is largely resignation. Among the home furnishings giants with gross margins reportedly at risk: Restoration Holdings and Williams-Sonoma.

Evolving Business

With 80 containers leaving Shanghai bound for San Francisco every week, Jay Shane supplies both of those specialty retailers and many others of like stature. But the maverick behind Shayne Global Holdings, long a powerhouse OEM supplier that today ranks among the leading upholstered furniture manufacturers in the world, remains stoic, if not downright optimistic. After all, he’s overcome adversity many times before.

Shayne Global Holdings has been devoted to the manufacturing of high-end fabric and leather upholstered goods since 1999. “The tariffs will happen very soon; it’s just a question of whether it’s 20 or 25 percent and that will definitely impact our bottom line,” he relates. “However, we are in the process of merging both U.S. and Mexican manufacturers to offer faster service to our customers, and we have worked out a formula to help our dealers weather the storm so that they can maintain their major programs with us in the coming years.”

The executive, who got his start in the leather apparel business, made “Top Gun”-style bomber jackets for all of the large department stores in the U.S., making him the no.1 supplier of the product in China. He had to subcontract work out to meet demand. As an early adopter of the Chen production system, which he’d brought to China from Taiwan — wherein every garment is broken down into multiple parts — Shane’s production techniques were six times faster than traditional Chinese operations at the time. In sub-contracting the work out though, he essentially created his own competition.

“But those factories didn’t understand marketing, so they went to all the state-owned companies and started to offer the goods 20 percent cheaper. It mushroomed fast, and soon store buyers were telling me, ‘We’ve known you for a long time, but we can no longer afford your product.’ We compromised, of course, and kept much of the business, but I could see the writing on the wall and began to try to figure out where we could transfer our skill sets, another industry that required labor-intensive cutting and sewing, similar to apparel.”

The answer, of course, was furniture, and Shane began supplying leather cut-and-sew kits to American manufacturers in 1994, purchasing leathers from Thailand because there were no tanneries in China at the time. In those early days, most of the goods supplied Rooms to Go, and later, Ashley. By 1997, Shane was tanning leather in China with help from an Argentinean technical support team, with prices consistently 15 percent lower than hides coming out of Italy with comparable quality. But like those in the aforementioned leather garment business, Ashley would launch its own factory in 2000. By then too, all those leather factories that had knocked off Shane’s apparel business model had begun to figure out cut-and-sew kits for furniture.

“In China, there’s a saying, ‘There’s no business good for three days,’” Shane says with a shake of his head. “Once again, I began to look at what was coming next, and that’s when we got into finished product.” That business too thrived for awhile, and he says, “we continually built up our supply chain, all in-house under one roof.” Of course, it wasn’t long before other kit suppliers got into the finished goods business, and it wasn’t long after that when the dam burst. “Everybody came to China, from Morty Seaman to Best Buy to Thomasville,” he relates.

That meant another transformation for the company. This time, however, the executive chose to extricate himself from the steady race to the bottom. “We began trading up into making better goods, meaning eight-way hand-tied construction. Everybody said it couldn’t be done, but I saw that we either had to be high-end or very low. There is no space in the middle anymore. So, we had to prove ourselves with better quality as we sought out better customers.”

Making Strides

Today, Shayne Holdings consists of nine vertically integrated factories in one compound located in Hangzhou. The company pours its own foam, operates two solid wood frame factories, a wood carving factory, a spray finishing plant, and three enormous upholstered furniture factories with some 65 product development people tasked with nothing but sampling. At any given time, the company carries an inventory of $15 million in fabrics and leathers alone.

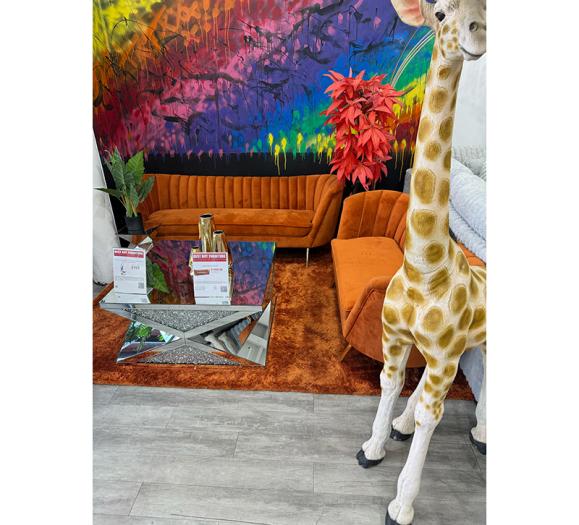

Products warehoused in California and High Point, NC, are marketed via Shayne USA, which has historically sold private label goods to all the well-known specialty retailers, and Spectra Home, which targets Top 100 and independent retailers, and most recently interior designers across the U.S.

While Shayne has already grown to become one of the largest customized bench-made upholstery manufacturers in the world, the business is by no means limited to that category. Along with stationary and motion groups, upholstered beds, benches, dining and occasional chairs, Shayne merged with a high-end casegoods company last year — enabling customers to purchase high-end upholstery and casegoods from one company under one roof. He also acquired EChine, a high-end company focused on the hospitality and contract business, and the company is opening brick-and-mortar stores in China under its own brand, Couture Living. The first flagship location opened in Hangzhou and will be followed by more stores in major cities across China this year.

Shane’s most recent achievement though is the one of which he is most proud. On August 15, the company went public on the Taiwan Stock Exchange (SGH, Stock Code 8482). “Everything is possible,” he says, “if you have the passion and the will.”