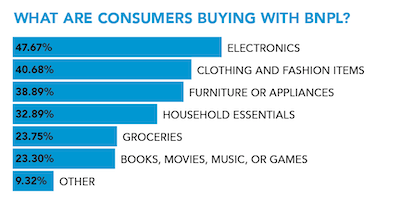

The growth of online shopping and lingering economic uncertainty from the coronavirus pandemic have made buy-now-pay-later (BNPL) services popular payment methods for shoppers. These point-of-sale loan services allow customers to finance their purchases, often with zero or low interest and without hidden fees. It can ease the financial burden for customers looking to make larger purchases in a time of economic uncertainty.

Financial analysis website The Ascent surveyed U.S. consumers about their BNPL habits in July 2020, and again in March 2021. The March survey indicated a nearly 50 percent growth in using BNPL services in less than a year (37.65 percent of consumers in July 2020 vs 55.8 percent in March 2021), indicating that the popularity of these services is growing.

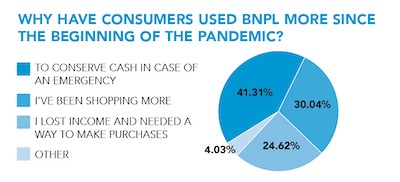

The COVID-19 pandemic has also played a role in consumers’ BNPL usage. Sixty-four percent of users say they have used it more since the pandemic started. Respondents indicated that they chose the BNPL option during the pandemic to conserve cash in case of emergency, because they’ve been shopping more, and because they’ve lost income and still need to make purchases.

Age may also play a role in the popularity of BNPL use. The Ascent’s surveys indicated 62 percent growth in consumers age 18 to 24 using a BNPL service; in March 2021, 61.61 percent of this age group had used a BNPL service. The research also showed a 20 percent increase in users age 25-54 during the July 2020 to March 2021 period, with 60.08 percent of this group having used a BNPL service. Respondents over the age of 55 showed a 98 percent growth during that period, but in March 2021 only 41 percent of those consumers had used a BNPL service.

There can be drawbacks to entering into a financing agreement for purchases, however. Almost a third of respondents (31.36 percent) have either made a late payment on a BNPL agreement or incurred a late fee. This was most prevalent in younger respondents, as 47.45 percent of 18- to 24-year-olds reported making a late payment or facing a fee. Further, 36.38 percent of respondents say they are very likely or somewhat likely to be late with a BNPL payment over the next year. In addition to charging late fees, BNPL service providers report late payments to credit bureaus, so this could have larger financial consequences for consumers down the line.

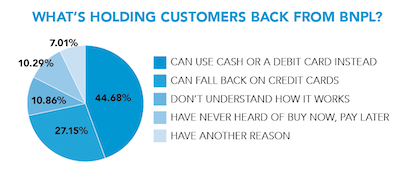

Despite the risks, some consumers think BNPL services could replace their credit cards. The survey showed that 27.42 percent of consumers would like BNPL services to replace their credit cards, while 34.95 percent would keep using their credit cards even if BNPL could replace their credit cards. Nearly 44 percent of respondents who have used a BNPL service say they do so more often than they use credit cards.