Even before the coronavirus pandemic, shoppers, who have basically unlimited access to research regarding the products they buy, had been paying much closer attention to the practices of the brands they buy, particularly in higher-priced purchases.

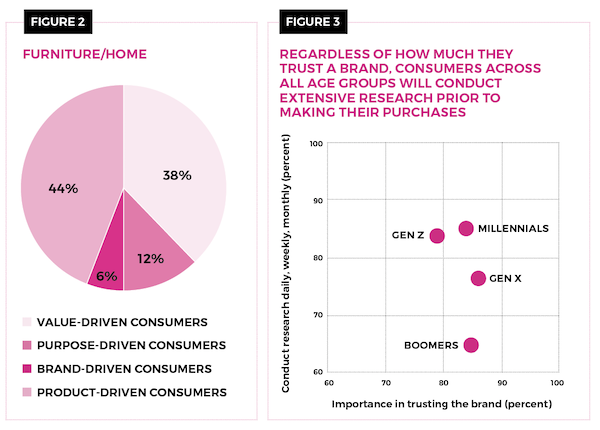

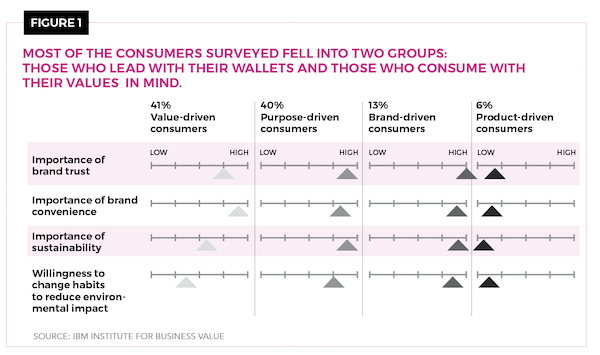

Consumers continue to fall into four main categories where purchases are concerned: value-driven, purpose-driven, brand-driven and product-driven, with the first two by far the most significant. In this month’s two-part assessment of the consumer and how sustainability plays into their purchases, we start with what consumers are looking for, based on research conducted by the National Retail Federation (NRF) and IBM Corp.

How are Consumers Shopping?

According to the NRF/IBM research, shopping had fundamentally changed prior to the coronavirus pandemic, as technology has increased the consumer’s access to product and brand information. “Throughout history, shopping has involved taking a trip, planned in advance, to a favorite store for which a consumer made time,” the report notes. “The e-commerce revolution has changed this predictable relationship and activity. Rather than going to a store people increasingly have purchased goods and services online, and sight unseen.”

According to the report, while shopping has been trending this way for almost a decade, we have mobile technology and social media to thank for a “rewiring” of consumers’ shopping behaviors that, until more recently, hadn’t taken full hold. With the onset of a pandemic that has made online shopping even more important, it is unlikely that these behaviors will revert back, as it was already one of the biggest shifts in consumer behavior. Consumers now shop in what the NRF/IBM report calls “micro-moments, whenever and wherever the mood strikes them, often while involved in other tasks.”

Consumers are driven by “micro-needs,” which reveal their desires for specific products or attributes that dovetail with what they consider important or valuable. More than 70 percent of respondents said they are looking for specific attributes that are important to them when choosing a brand, such as environmental responsibility.

While this trend toward online shopping and research continues, brick-and-mortar retail continues to have significance, even as it morphs into something different. Many shoppers continue to crave convenience and immediacy, and stores are critical touchpoints in the omnichannel supply and fulfillment ecosystem. For consumers who desire experiential and/or communal shopping, the report continues, stores have become showcases for them to have hands-on engagement with products

and brands.

Values as Important as ‘Value’

Most consumers fall into one of two segments according to the NRF/IBM report: value-driven consumers, who are primarily concerned with getting their money’s worth and select brands based on price and convenience; and purpose-driven consumers who select brands based on how well those brands align with their personal values and are willing to “walk the talk” when it comes to sustainability and changing their behaviors. More than half of value-driven consumers fall into below-middle income status, while purpose-driven consumers are often willing to pay a premium for products and services that reflect their values and lifestyle. Purpose-driven consumers are also willing to change their shopping routine to reduce environmental impact and care about issues such as sustainability and other eco-friendly practices.

The Sustainable Shopper

Retail and consumer products companies around the world have increased their focus on sustainability over the past half decade. According to a McKinsey ESG (Environmental, Social and Governance ) report, in the past five years, global sustainable and environmentally responsible investment is up 68 percent and now tops $30 trillion. More and more, awareness of global environmental issues is changing the habits of consumers wherever they live. Already, significant numbers of people have adopted a back-to-basics mindset, opting for products that are simple, are fresh and contain fewer or no preservatives or processed elements.

Consumers, for their part, continue to embrace not only awareness of environmental responsibility but also are looking for the brands and products that take that responsibility seriously in their materials choices and practices. Seven in 10 consumers say it’s at least moderately important that the brands they shop for offer sustainable and environmentally responsible products as well as supporting recycling, according to the NRF/IBM Research Insights report.

Shopping for the Environmental Good

Nearly 6 in 10 consumers (57 percent), overall, for example, are willing to change the way they shop to help reduce negative impact to the environment, and among those who say sustainability is important for them, this jumps to 77 percent, according to the NRF/IBM research. More importantly, perhaps, seven in 10 are also willing to pay a premium for brands that support recycling, practice sustainability and/or are environmentally responsible.

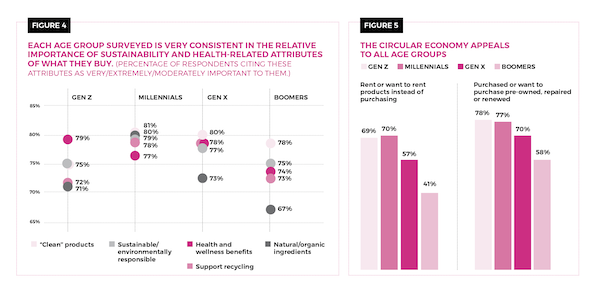

And these practices are not a matter of age or generational divide. While Millennials may be frontrunners in sustainability awareness, a product’s environmental and/or personal wellness attributes are significant considerations across generations. While Gen Z cites health and wellness as their top priority, clean products are most important for the other groups. Interestingly, natural/organic attributes are of lower importance across age groups.

As far as sustainability is concerned, consumers are looking for information about how products are made as well as the materials used. Traceability is important to 73 percent of the consumers surveyed. They also want to understand corporate sustainability policies and want assurances that brands support recycling and social responsibility.

New Consumption Models

As part of consumers’ increasing focus on sustainability, they are challenging traditional purchasing models in some cases and turning to new consumption models that are offering up creative opportunities for new players. Two such new retail models, which impact the “circular economy” — reuse and/or upcycle existing products — offers alternative ways to attain products like renting or buying pre-owned goods. In more expensive categories, such as home furnishings where many pieces can be reused, this is becoming more prevalent.

When it comes to purchasing pre-owned, repaired or renewed products, according to NRF/IBM Research Insights, 70 percent of respondents have tried or would like to try such practices, and 84 percent who have tried them plan to continue. As for renting products, nearly 60 percent of those surveyed have tried it or would like to, and 77 percent of those who already do plan on doing it again.