Houzz Inc. has released the Q3 2020 Houzz Renovation Barometer, which tracks residential renovation market expectations, project backlogs and recent activity among businesses in the construction sector and the architectural and design services sector in the U.S. The Houzz Barometer, which was fielded from June 27 to July 10, 2020, reports that nearly all business indicators have returned to pre-pandemic levels, following a dramatic drop in early Q2. It also shows that businesses have a more positive outlook for 2020 than they did at the beginning of the COVID-19 pandemic.

“Confidence has returned to the home renovation and design industry, with many more businesses showing a positive outlook for 2020 than just a few months ago,” said Marine Sargsyan, Houzz senior economist. “Expectations for business inquiries and new committed projects have completely rebounded, following a sudden decline when the pandemic was declared. This is supported by an increase in new project inquiries in Q2, suggesting that homeowners are getting ready to renovate. Home professionals are finding ways to move projects forward with new safety guidelines, remote collaboration tools, and online consultations, invoicing and payments.”

COVID-19’s Influence on Home Renovation and Design Businesses

More than four in five small businesses in the architectural and design services sector and the construction sector have been impacted by the coronavirus pandemic (84 and 83 percent, respectively). The most common effects include project delays (72 and 77 percent, respectively), fewer new business inquiries (66 and 57 percent, respectively) and project cancellations (61 and 58 percent, respectively). That said, each of these effects were reported by fewer businesses as compared with the Q2 2020 Houzz Barometer. Shipment delays or cancelations, on the other hand, are a growing concern for businesses in both sectors (55 and 62 percent in Q3 versus 41 and 50 percent in Q2).

Architecture and design firms responded to pandemic-related business challenges by offering video consultations, providing remote collaboration tools, sourcing more products online, and implementing safety guidelines at the office and worksite (59, 49, 45, 45 percent, respectively). Construction businesses implemented new safety guidelines, utilized video consultation tools and sourced more products online (62, 37 and 33 percent, respectively). The two solutions adopted significantly more frequently since last quarter by businesses in both the architectural and design services sector and the construction sector were video consultations (49 and 30 percent, respectively, in Q2) and online product sourcing (34 and 26 percent, respectively, in Q2). More than a quarter of businesses in the architectural and design services sector and the construction sector also adopted online invoicing and payments (33 and 24 percent, respectively). Many of these solutions are supported by the Houzz Pro business and project management software.

Despite pandemic-related headwinds, as well as pricing and availability of materials, labor shortages and the current political climate, more businesses in the construction sector and architectural and design services sector report a neutral to good outlook for 2020 (82 and 73 percent, respectively, compared with 66 and 56 percent, respectively, in Q2).

Q3 2020 Construction Sector Barometer

The Expected Business Activity Indicator related to project inquiries and new committed projects increased significantly to 75 in Q3 (compared to a low of 18 in Q2 and slightly higher than the Q1 reading of 74). Expectations for project inquiries were up at 79 and new committed projects were at 71.

The Project Backlog Indicator increased to 6.2 weeks in Q3 relative to Q2, which is 1.3 weeks longer than a year ago.

The Recent Business Activity Indicator related to project inquiries and new committed projects increased slightly to 49 in Q2 (compared to 48 in Q1). This is driven by an increase in project inquiries, which grew to 51 in Q2 (up five points relative to Q1), and by a decline in new committed projects to 46 (down four points relative to Q1).

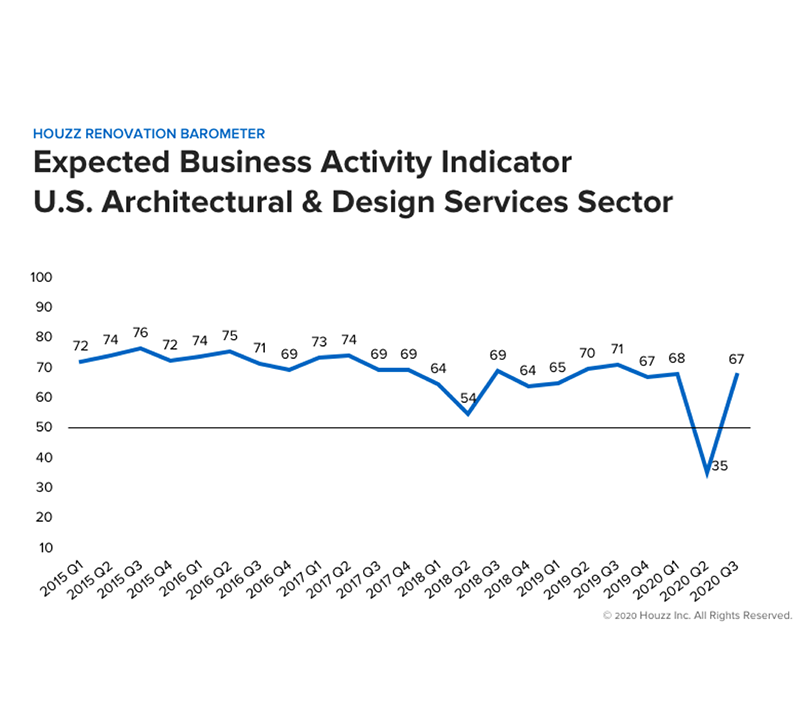

Q3 2020 Architectural and Design Services Sector Barometer

The Expected Business Activity Indicator related to project inquiries and new committed projects increased significantly to 67 in Q3 (compared to 35 in Q2 and 68 in Q1). Expectations also increased for project inquiries to 71 and for new committed projects to 64 in Q3.

The Project Backlog Indicator increased to 4.5 weeks in Q3 (relative to 3.6 weeks in Q2), which is only 0.2 weeks shorter than a year ago.

The Recent Business Activity Indicator related to project inquiries and new committed projects increased to 48 in Q2 (compared to 44 in Q1). This is driven by a growth in project inquiries to 53 (up 14 points in Q2 relative to Q1), and a decrease in new committed projects to 43 (down seven points relative to Q1).