Out with the jack-o-lanterns, in with the snowmen. The season of giving starts this month, and research shows that consumers plan to give — a lot.

Coresight Research’s latest projections show growth by 4 percent year over year in 2018, increasing from $692 billion last year to $720 billion in 2018, and the firm says it’s possible that sales will top that 4 percent.

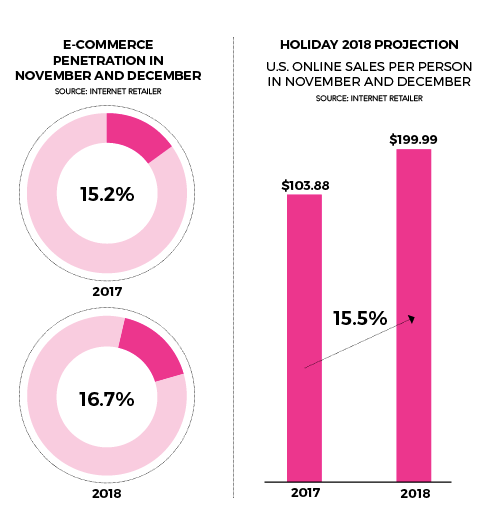

On the e-commerce end, sales will likely grow as more people complete their holiday shopping online. Coresight expects the percentage of holiday retail shopping done online will increase by 16 percent year over year. Research from e-commerce business publication Internet Retailer came to a similar conclusion, expecting a 15.5 percent increase in online sales from last year.

Overall, consumers are more optimistic about the economy and more confident about their job security. Coresight listed the tax cuts earlier this year, rising wages, low unemployment and modest inflation as contributing factors.

But there are potential problems on the horizon. While wages are rising, they’re not growing faster than inflation rates, which means those wage gains end up going towards more expensive necessities.

And finally — the elephant in the room — tariffs.

At press time, trade negotiations between the U.S. and China have not reached any agreements. On Jan. 1, 2019, the U.S. will raise its tariffs on $200 billion worth of Chinese goods from 10 percent to 25 percent. Those goods include furniture and lighting products, but perhaps more importantly, they include food and other everyday items.

Apprehension over increased grocery bills and inflation could lead consumers to be more conservative in their holiday spending. One third of those responding to University of Michigan’s Survey of Consumers in September said they were concerned with the negative impact of tariffs on the economy, which means consumers will almost certainly be watching and ready to hold off on holiday spending if the tariffs look imminent.

Coresight concluded its report saying, “Shoppers stand ready to open their wallets this holiday, but we think that retailers should not expect a spectacular end to the year.” In short, retailers can expect spending to grow, but if any retailers are relying heavily on the holidays in the same way Toys “R” Us did last year, they will likely face a lump of coal in their cash registers.