The American Society of Interior Design's (ASID) Second Quarter Billings Index report, released last week, made one thing exceptionally clear: The interior design industry has deep ties to the housing industry.

Mixed results in ASID's report — created by Jack Kleinhenz, Principal and Chief Economist at Kleinhenz & Associates, and Susan Chung, Director of Research and Knowledge Management at ASID — paint an overall optimistic outlook with a few serious caveats on the horizon.

Read on to see where the industry might be headed and what could make or break it.

Billings and inquiries are down

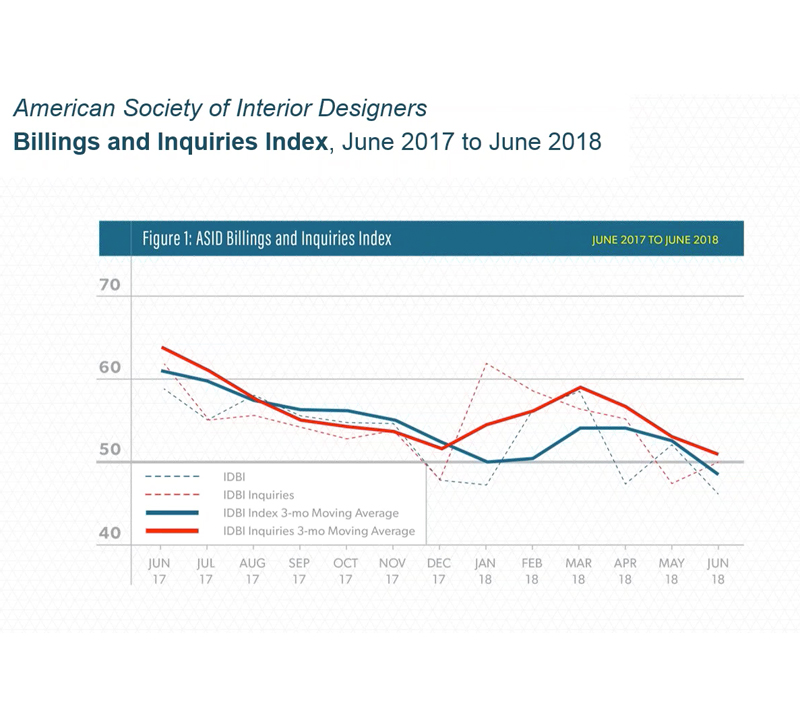

ASID measures growth and contraction in the industry by looking at the monthly moving average of inquiries (the number of potential clients that have reached out to interior design firms) and billings (the amount of billings firms are taking in). Kleinhenz charts growth and contraction on a scale based around the 50 mark — anything above 50 is consider growing and anything below is contracting.

Billings (the thick blue line) dipped below 50, and inquiries (thick red line) appear to be headed that way as well. Clearly, this isn't the first time these lines have rested on the 50 mark, but seasonally, it's a little concerning. In January and February when these lines were also low, consumers were just coming off a major holiday season, so it made sense that theyneeded some time to bounce back before taking on a home project. In March, those lines picked back up as expected.

In the summer months, however, that expansion and growth did not continue. Compared to last year (see the 2017 second quarter results here) when both lines were well above the 60 mark, this is definitely troubling to say the least. Looking back on that report and the uncertainties Kleinhenz outlined then, interior designers should be concerned, though not anywhere near panicking just yet.

Why not? Kleinhenz says the economy's solid growth in the second quarter doesn't seem to be slowing down. Though consumers seemed to be concerned about inflation, spending remains pretty high.

That said, the interior design industry shares close ties with the housing market construction industry — both of which have been struggling. According to Kleinhenz, housing sales, new construction and repairs have all been slow, and as new furniture and design service purchases usually come with home building and buying, it's not surprising that the interior design industry is taking a hit as well.

Housing affordability will likely play a major role in the growth or contraction of the interior design industry. As new home construction prices rise because of increased costs in building materials and labor, fewer people can build new homes, and there's more competition for existing homes, which raises those costs that fewer people can meet. This trickle-down effect, coupled with the rising interests rates that stop people from getting affordable mortgages, will cause serious problems for the interior design and overall home design industries.

All things considered though, Kleinhenz remains optimistic and expects to see a rebound in the next report.

"My view is that I think conditions should improve in the economy," he concludes. "We've got to recognize that the housing sector has struggled during this expansion and it probably will continue, but overall I think this is a good report and a good stepping off as we approach the remainder of 2018."

Interior designers expect positive end to 2018

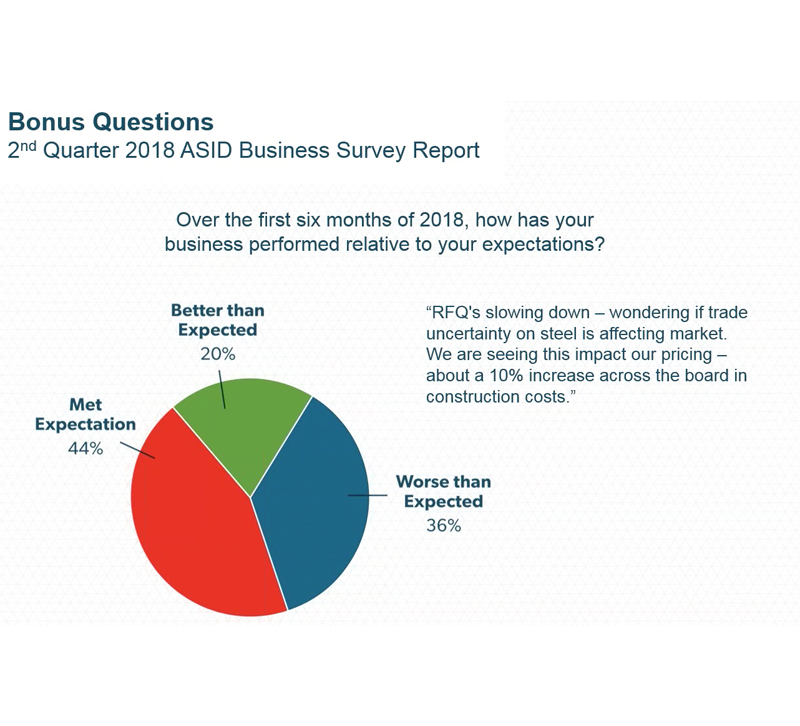

While the inquiries and billings index should give designers plenty to consider, over half of designers surveyed reported meeting or exceeding expectations for their business in 2018, and that's good news.

Unfortunately though, the number of respondents who answered "Worse than expected" also grew, up from 20 percent at the same time in 2017. Back then, respondents cited construction delays and fallen projects as their biggest issues, and this year follows a similar pattern. Steel and other building costs have risen, which lead to fewer and smaller projects as well as delays and cancellations.

That said, interior designers remain optimistic about the rest of 2018. When asked about expected growth for the remainder of the year, only 23 percent said they expected zero or negative growth. About 42 percent said they expected an increase in sales from 5 to 9 percent — not a massive amount as Susan Chung, Director of Research and Knowledge Management at ASID, noted, but growth nonetheless.

Over 80 percent of respondents said they hadn't seen any effect from tariffs and trade policies on their businesses, but it's worth pointing out that tariffs on imported furniture haven't been determined just yet. The Trump administration plans to levy a tariff between 10 and 25 percent on imported Chinese furniture, which will certainly affect the industry as we've reported. Likely, the interior design industry won't see those effects until early next year.

This is a lot of information to take in, so tell us: What do you make of ASID's second quarterly report? Share with us in the comments!