Good news for interior designers: the latest quarterly report from the American Society of Interior Designers (ASID) shows a good tilt forward and upward. The Interior Design Billings Index, which ASID released in a press conference this Tuesday morning, indicates that the interior design industry is growing and mostly on trend with where experts thought it to be at the beginning of the year.

"All in all, I think it suggests that the quarter has been okay," Jack Kleinhenz, Ph.D., Principal and Chief Economist at Kleinhenz & Associates, said during the conference Tuesday morning. Kleinhenz's firm, Kleinhenz & Associates, works with ASID Research to produce these monthly and quarterly reports.

Though the report encourages positivity, Kleinhenz and Susan Chung, Senior Associate at ASID Research, outlined a few potential problems that may affect the industry in the second half of the year and beyond.

So what's in the report? Here are three takeaways you need to know.

Positive outlook for the industry

Overall the design industry saw plenty of positive trends in the 2nd quarter report.

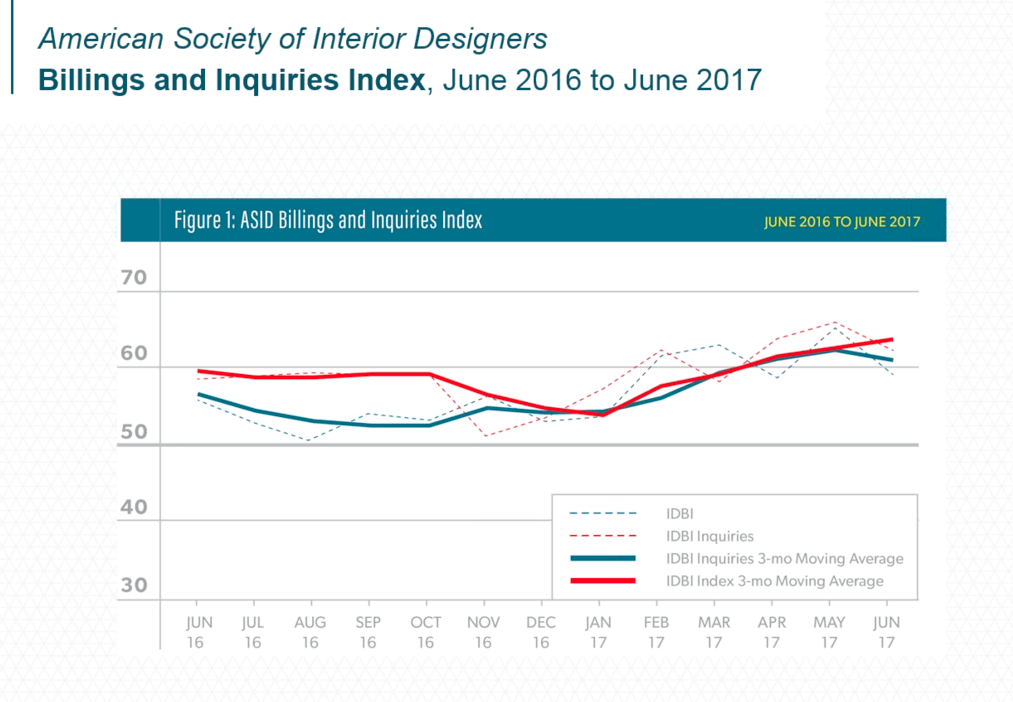

Both billings and inquires for all firms remained above the 50 mark. Anything above the 50 mark means there have been gains in revenue and expansions in the firm. The average here sits just above 60.

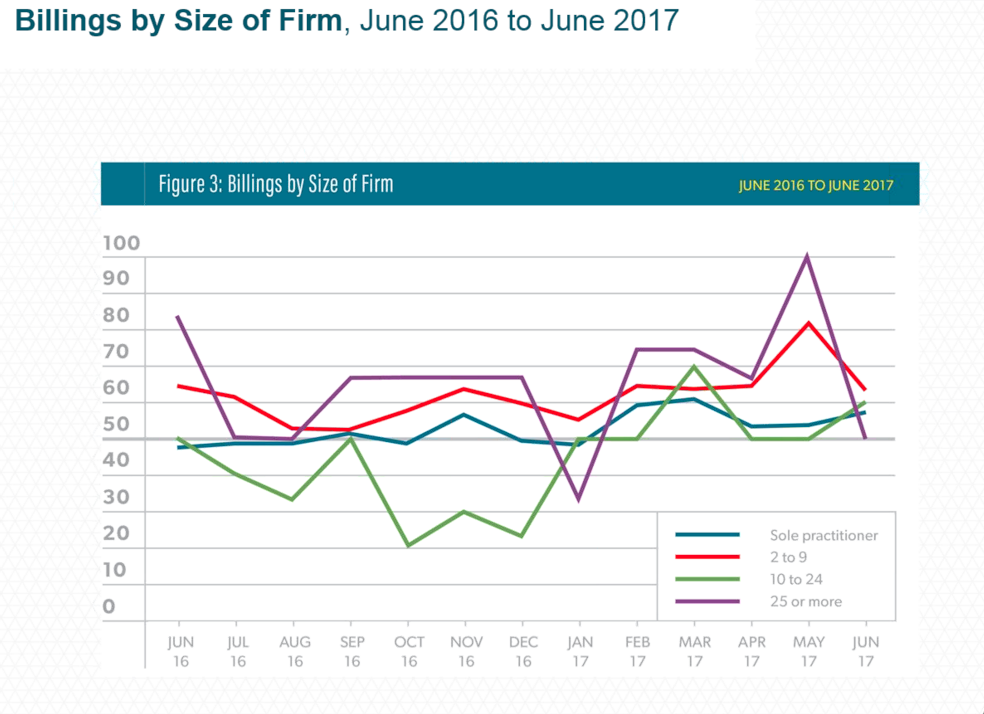

Mid-sized firms saw their billings even out a bit more above the 50 mark. Sole practitioner and small firms remained fairly steady while large firms saw a fairly dramatic drop, landing right on that 50 mark.

Further data from the 2nd Quarter 2017 ASID Business Survey Report showed that overall, designers were generally on par with their expectations for the year. Forty-six percent of responders said the first half of the year met expectations, and 34 percent said it had exceeded their expectations. When asked why business performance was doing better than expected, respondents said unexpected repeat business contributed to their success, as well as more inquiries signed.

Among the 20 percent who reported worse than expected business performance, many sited fallen projects and delays on construction as main reasons for poor performance. Chung added that delays will probably right themselves and show themselves on the next quarter report.

New, promising talent is in demand

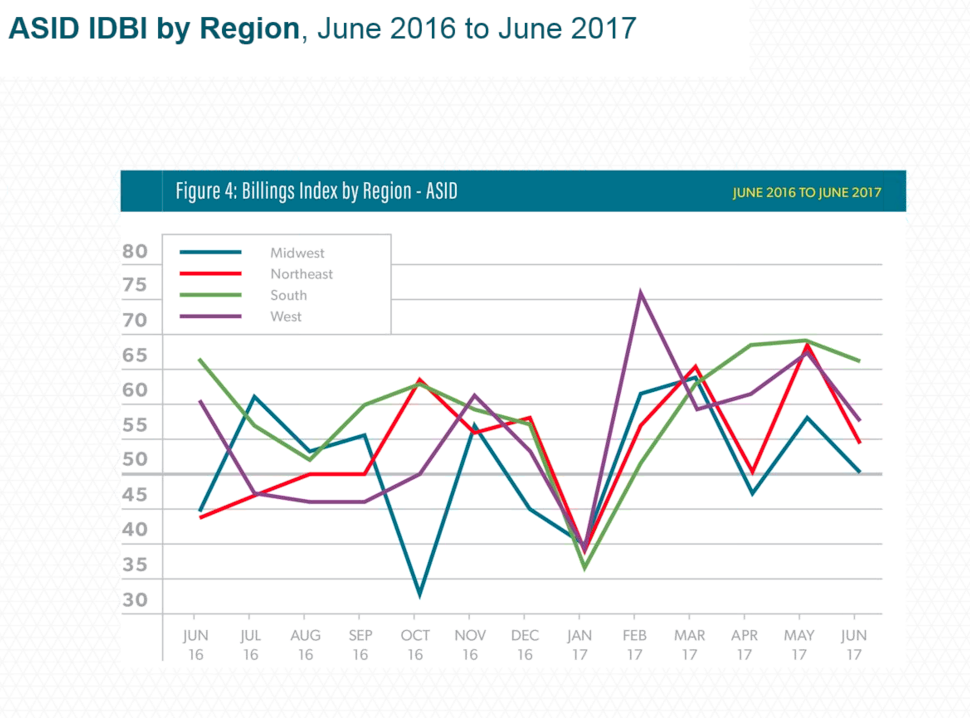

Talented designers looking for work should find themselves with plenty of options, especially in the southern region of the U.S. According to the 2nd Quarter 2017 ASID Business Survey Report, 30 percent of respondents said they have either hired or planned to hire new employees in 2017. Fifty-four percent of those respondents were from firms in the South.

Entry- and mid-level designers seem to be in the biggest demand. Of those who said they would or had already hired, 48 percent said they were looking for designers with zero to four years of experience — good news for designers just coming out of school. Another 35 percent said they were looking for mid-level designers with five to 10 years of experience.

Using the data from June 2016 to June 2017, it appears the South repeats a pattern: low billings in the winter that peak at summer and then drop back. The South region started off the year with its Billing Index down at 36, but it saw a steady incline to about 69 in May and a slight drop to about 66 in June — almost exactly where it was at this point last year.

For new designers fresh out of school or those with a few years of experience looking to make a change, the South may be a great place to jumpstart a career and continue professional development. Firms of all sizes were part of that 30 percent who said they would hire or have hired, and respondents cited "recruiting and retention" as their biggest concern.

It appears to be a designer's job market. When applying for jobs, designers should be highlighting all aspects of their work, from in-home designs to job performance to social media following.

Uncertainties remain

Though the report gave designers plenty to be excited about, there are some uncertainties, but nothing to be too concerned with just yet.

Sources have been mixed on new houses built and home sales. Traditionally, Kleinhenz says, there's been a strong positive correlation between furnishings spending and new homes built and homes sold. Some reports on the housing market have been less than positive, and though more people have been able to get residential mortgages for remodeling projects, Kleinhenz notes some reluctance among consumers to use credit to fund these projects, calling it a "delicate balance."

Consumer spending on goods has also decreased while spending on services has increased. The personal consumption expenditure on furniture and durable goods dropped from the previous quarter. Kleinhenz says that this drop could signify a price drop: More goods were sold, but at a lower price.

Despite these uncertainties, Kleinhenz remains optimistic.

"Nothing is standing out in front of me indicating some major red light or even a yellow light," he said. "It's been considered kind of a Goldilocks effect — not too hot, not too cold.”

Chung also pointed to another uncertainty in the industry: online design businesses. Consumers, she said, have been exposed to a wider variety of types of interior design services through the internet. Services such as Home Polish and Havenly offer interior design services over the internet and at a fraction of the cost of traditional firms. Chung remained unsure of how these new design services would affect the industry overall, but she stressed that firms should be preparing themselves.

"One thing is evident," Chung stated. "There will be change.”